Commercial Vehicles

SECTION 179 TAX DEDUCTION INFO

Save now on Qualifying Vehicles.*

What is the Section 179 tax deduction?

Section 179 of the IRS tax code allows businesses to deduct the purchase price of qualifying vehicles purchased or financed during the tax year. That means that if you buy or lease a vehicle for your business, you can deduct it from your income.

Who qualifies for Section 179?

All small businesses that purchase, finance or lease vehicles during tax year 2016 should qualify for the Section 179 Deduction.

When can I take advantage of the Section 179 tax deduction?

Section 179 can change each year without notice, so take advantage of this tax deduction now, while it's available. To qualify, the vehicle purchased, financed or leased must be placed into service between January 1, 2018 and December 31, 2018.

What vehicles qualify for the full Section 179 tax deduction?

Vehicles that are not used for personal purposes qualify for the full Section 179 tax deduction including the following:

- Heavy “non-SUV” vehicles with a cargo area at least six feet in interior length (this area must not be easily accessible from the passenger area.) In other words, a cargo van, like the Nissan NV.

- Vehicles that can seat nine-plus passengers behind the driver's seat. In other words, a vehicle like the Nissan NV Passenger van.

What other vehicles qualify for Section 179?

Passenger vehicles that are used more than 50% of the time for business use. In other words, virtually any Nissan car, truck, van or SUV.

What else do I need to know?

- The vehicle can be financed, leased or bought outright.

- Section 179 must be claimed in the tax year that the vehicle is placed in service.

- A vehicle first used for personal purposes doesn't qualify in a later year if its purpose changes to business.

What is Section 179’s “more than 50% business use” requirement?

The vehicle must be used for business purposes more than 50% of the time to qualify for the Section 179 Deduction. Simply multiply the cost of the vehicle by the percentage of business use to arrive at the monetary amount eligible for the Section 179 tax deduction.

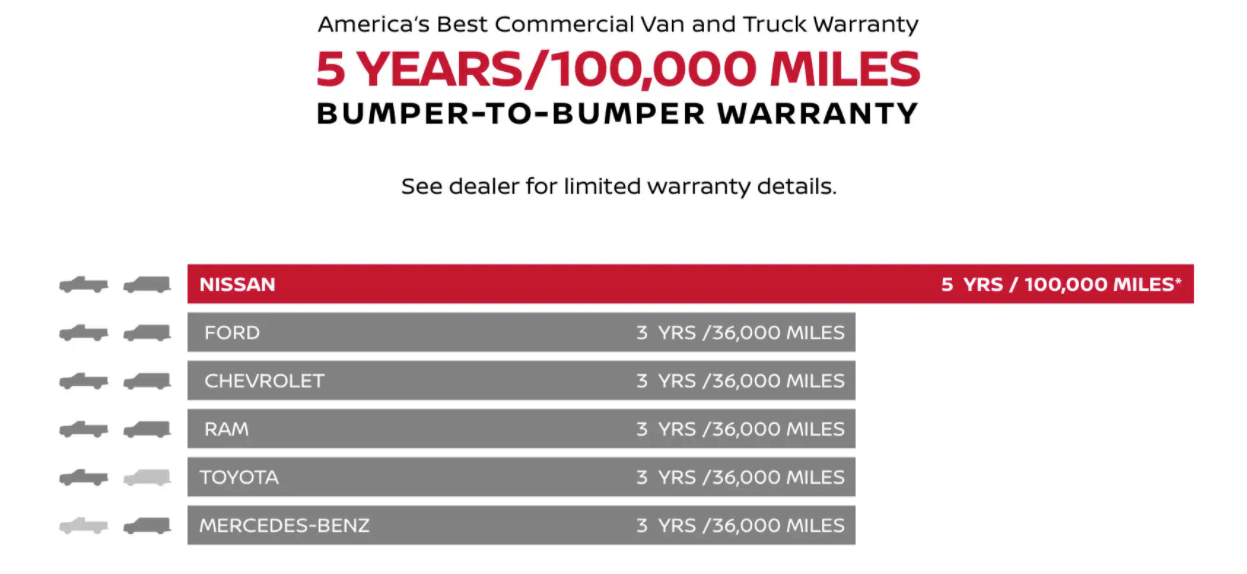

COMMERCIAL VANS & TRUCKS

5 YEARS/ 100,000 MILES

AMERICA'S BEST TRUCK & COMMERCIAL VAN WARRANTY

See dealer for limited warranty details.

Backed by America's Best Truck & Commercial Van Warranty: 5 years, 100,000 Miles Bumper-to-Bumper*, these work vehicles handle any job like a pro.

CONFIDENCE COMES STANDARD

A lot goes into making sure our vans are some of the toughest on the road. That’s why we have the confidence to back the entire NV lineup with America’s Best Commercial Van Limited Warranty.